Investor interest in commodities, including oil, has risen dramatically over the last decade and commodities have become a new asset class in institutional investors’ portfolio. Partly, this development is due to diversification benefits. In addition, the development of new investment vehicles, such as exchange traded funds, has allowed individual investors to get exposure to movements in commodity prices. Due to the storage and trading costs associated with direct physical investment in commodities, the main vehicle used by investors to gain exposure is via commodity indices (baskets of short maturity commodity futures contracts that are periodically rolled over as they approach expiry), exchange traded funds or other structured products. These instruments provide generally long-only exposure to commodities.

Investors are exposed to three sources of returns in total-return commodity index investments. The first type is the yield on the underlying commodity futures. The second type is the roll return, which is generated from the rolling of nearby futures into first deferred contracts. A forward curve in contango (when longer-dated futures prices are higher than nearby contracts) generates negative roll yields, while backwardation (when nearby prices are higher than longer-dated futures prices) provides positive roll yields. The third type is the Treasury-bill return, which is the return on collateral. Historically, the roll return has constituted the largest contributor in total returns. However, it has been negative since 2005 for the S&P GSCI Total Return Index, due to the contango market evident in crude oil futures markets.

Institutional investors generally gain exposure to commodity prices through their investment in a fund that tracks a popular commodity index. The fund managers themselves either directly offset their resulting short positions by going long in futures markets or by entering swap agreements with a swap dealer. In turn, swap dealers in the OTC market generally go long or short in the futures market to offset their net long (or short) position. Of course, the client base of swap dealers also includes traditional hedgers.

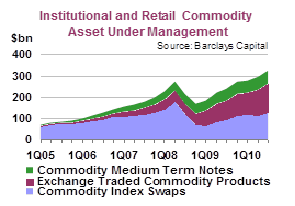

The size of commodity index investment has been difficult to measure due to netting issues, as well as inadequate reporting requirements in the US and other countries. Although the US CFTC releases several different aggregated data on swap dealers and commodity index traders positions, these data do not provide accurate information on the extent of commodity index investment. One such report is the CFTC’s commodity index trader report (‘COT Supplemental’), which provides information on weekly index traders’ position in selected agricultural markets. Unfortunately, the reported position typically over-estimates the size of commodity index investment. This is because the CFTC, which by special call had identified some traders as index traders (‘CITs’), classifies all those traders’ positions as index-related, regardless of trading activities.

For this reason, studies using COT Supplemental reports are subject to a bias in assessing index trading activity. A second and more realistic data set, called ‘index investment data,’ is published monthly by the CFTC. It specifically identifies commodity index investment activities on exchange and over-the counter market of these same traders. However, this data set likely underestimates the size of index investment due to exclusion of some index traders.

The coincident influx of money into commodity indices and rising commodity prices, especially after 2003, has led to claims that commodity index traders are one of the major causes of the increase in the prices, especially for oil. Indeed, some argue that index traders’ strategic allocation changed the way in which commodity prices behave. However, others argue that the increase in commodity index investment is due to the first sustained demand driven price shock of the last 20 years, which started in 2004. Expectations of continued strong economic growth in Asia and other emerging economies might explain both the resurgence of commodity prices and the increased appetite for commodities by investors. In addition, some argue that activities of long-only commodity index investment might help to reduce the cost of hedging since commodity index traders are essentially willing to take the opposite position from short hedgers at lower prices than traditional speculators. This debate is sure to continue.

*IEA Oil Market report January-2011

Do you need a genuine Loan to settle your bills and startup

ReplyDeletebusiness? contact us now with your details to get a good

Loan at a low rate of 3% per Annual email us:

Do you need Personal Finance?

Business Cash Finance?

Unsecured Finance

Fast and Simple Finance?

Quick Application Process?

Finance. Services Rendered include,

*Debt Consolidation Finance

*Business Finance Services

*Personal Finance services Help

Please write back if interested with our interest rate datanfincorpfinance@gmail.com